Bond duration calculator

Bond valuation is a technique for determining the theoretical fair value of a particular bond. The duration of the trial period of subscription will be specified during first use.

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Bond Face ValuePar Value - The face value of the bond also known as par value.

. F is the face value of the bond. If you enter a 0 zero and a value other than 0 for the Yield-to-Maturity SolveIT. Use the Bond Present Value Calculator to compute the present value of a bond.

It is also referred to as discount rate or yield to maturity. BetterBond Call us on 0800 007 111 Get started Login Search. Fixed income investments can be a valuable source of income and properly used can help you to grow your wealth prepare.

Buy Car Calculator. The effective maturity of a bond and its sensitivity to changes in interest rates. Aims to generate income from rising bond prices and declining interest rates.

Adjustable Rate Mortgage Calculator. Trial period is intended to allow Users to try and experience the services. Zero Coupon Bond Formula.

Modified duration follows the concept that interest rates. Calculating Yield to Maturity on a Zero-coupon Bond. Duration is expressed as a number of years.

R is the yieldrate. Bond additional payment calculator. ZCBV F 1rt.

Current Bond Trading Price - The trading price of the bond today. Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate. Bond price - while bonds are usually issued at par they are available in the resale market at either a premium or a discount.

T is the time to maturity. CDs bonds and bond funds and even stocks for longer periods 30 percent or much more if youre investing in stocks CDs and bonds are relatively low risk compared to stocks which can. Also the price of the bond and the interest rates are inversely related.

But even in what it terms a soft-landing scenario the longer duration bond will be comfortable in the 225-25 range. However the duration is only a linear approximation. Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates.

PVBP Price Value Basis Point Calculator. Years to Call - The numbers of years. Amount borrowed of the bond at the maturity date as well as interest called the coupon over a specified amount of timeThe interest is usually payable at fixed intervals.

When you invest in a total bond market index fund you are adding exposure to the entire US. Invests in AA and above rated corporate bonds across the maturity spectrum. The Federal Reserve has started to taper their bond buying program.

Use Bond Calculator to calculate return on bond investment quickly accurately. Bond duration is also a measure of a bonds sensitivity to interest rate changes. Will calculate the Current Price.

Modified duration is the estimate of the price change of the bond for a 1 move in interest rates. Macaulay and Modified Bond Duration. Where ZCBV is the zero-coupon bond value.

The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term. Specifically the duration is the first derivative of the bonds price as it. Zero Coupon Bond Definition.

When comparing two bonds calculating duration makes it easier to tell which one. On this page is an annual percentage yield to annual percentage rate or apy to apr calculator. Figure the Market Value of Bonds.

Focuses on credit quality risk-adjusted returns and liquidity. If there is a premium enter the price to call the bond in this field. On this page is a bond duration calculatorIt will compute the mean bond duration measured in years the Macaulay duration and the bonds price sensitivity to interest rate changes the modified duration.

Once you are done entering the values click on the Calculate Bond Duration button and youll get the Macaulay Duration of 1912 and the Modified Duration of 1839. A standard ARM loan which is not a hybrid ARM either resets once per year every year throughout the duration of the loan or in some cases once every 6 months throughout the duration of the loan. In finance a bond is a type of security under which the issuer owes the holder a debt and is obliged depending on the terms to repay the principal ie.

You can easily calculate the bond duration using the Bond Duration Calculator. 2 What is the bonds Modified Duration. Check out the easy to understand bond pricer online to know Bond YTM and prices now at IndiaBonds.

Aims at portfolio duration range between 1 year and 5 year with median range between 2 year. Calculate how much you can save in terms of both time and money by paying a little extra into your bond. Find out more about bond repayment terms.

Yield to Call Calculator Inputs. Edelweiss Corporate Bond Fund. You can input either the market yield or yield to maturity or the bonds price and the tool will compute the associated durations.

The unit of bond duration is expressed in years. Use our bond calculator to estimate what you can comfortably spend on your new home before you start your property search. The ASX bond calculator is used to calculate bond prices and yields for Exchange-traded Australian Government Bonds AGBs and other standard fixed interest bonds.

Price to Call - Generally callable bonds can only be called at some premium to par value. Face Value is the value of the bond at maturity. Bond valuation includes calculating the present value of the bonds future interest payments also.

Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. Therefore if a bond has a duration of 5 years it signifies that for every 1 increase in the interest rate the price of the bond will fall by 5 and vice-a-versa. If a bond is quoted at a discount of 86 enter 86 here.

Simply enter the following values in the calculator. If you are uncomfortable locking up your capital for an extended period of time you may want to look into shorter duration CDs or flexible money market accounts. Bond market to your portfolio.

The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. Sometimes you have an APY or annual percentage yield and need to compare to an APR or annual percentage rateAPR does not tell you the true cost of debt or a loan since it isnt compounded. Bond Present Value Calculator.

A zero-coupon bond is a. The weight of each cash flow is determined by dividing the present value of the. One way to fairly compare two terms is to convert the APY into an APR for a.

We recommend trading rates with a bullish bias adding to longs on backups. How to Use the Bond Calculator Your inputs. If you select a longer term your monthly repayments will be lower but you will pay more in interest over the duration of the home loan.

Lock in todays low rates and save. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate.

The following formula is used to calculate the value of a zero-coupon bond. Semiannual annual and less often at other periods.

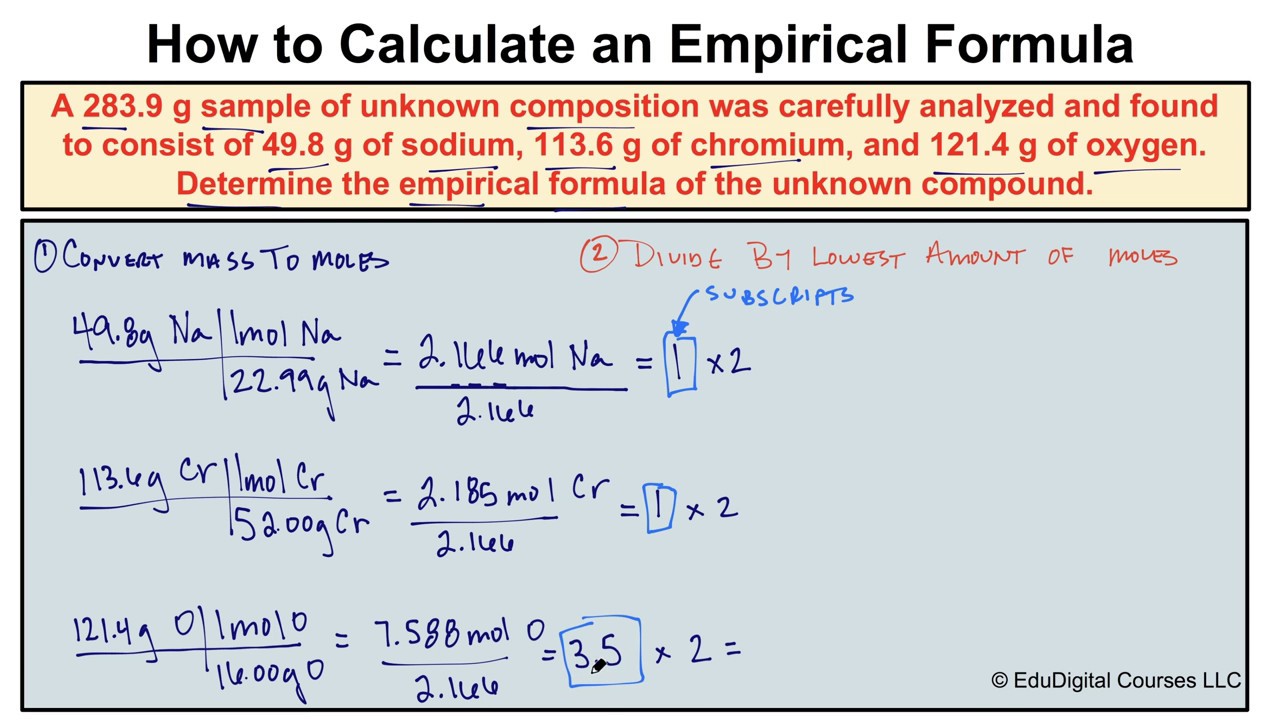

How To Calculate An Empirical Formula Chemistry Worksheets Scientific Method Worksheet Chemistry Notes

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Loan Payoff

Pin On Ch 4 Bond Valuation

Bond Yield To Maturity Calculator Printer Driver Organization Development Results Day

3 Ways To Calculate Bond Order In Chemistry Wikihow Teaching Chemistry Chemistry Classroom Chemical Bond

Nox Calculator Hybrid Car Calculator How To Find Out

How To Calculate Diluted Eps Financial Analysis Basic Concepts Financial

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Https Aarwinsworldoffinance Com Financial Calculator Math Materials Graphing Calculator

27 How To Calculate Enthalpy Change Using Bond Energies Gif

Valuation Of Bond Or Debenture Find Out More Bbalectures Com Bond Business Articles Financial Markets

Excel Sum And Offset Formula Tutorial Excel Excel Macros Microsoft Excel

Step 1 Capital Structure Of A Company Cost Of Capital Calculator Step Guide

How To Calculate Bond Enthalpy Using A Cycle A Level Chemistry Tutor Youtube Chemistry Lessons Chemistry Tutor

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Investing Stock Market